Podcast (berkshire-business-outlook): Play in new window | Download

Subscribe: RSS

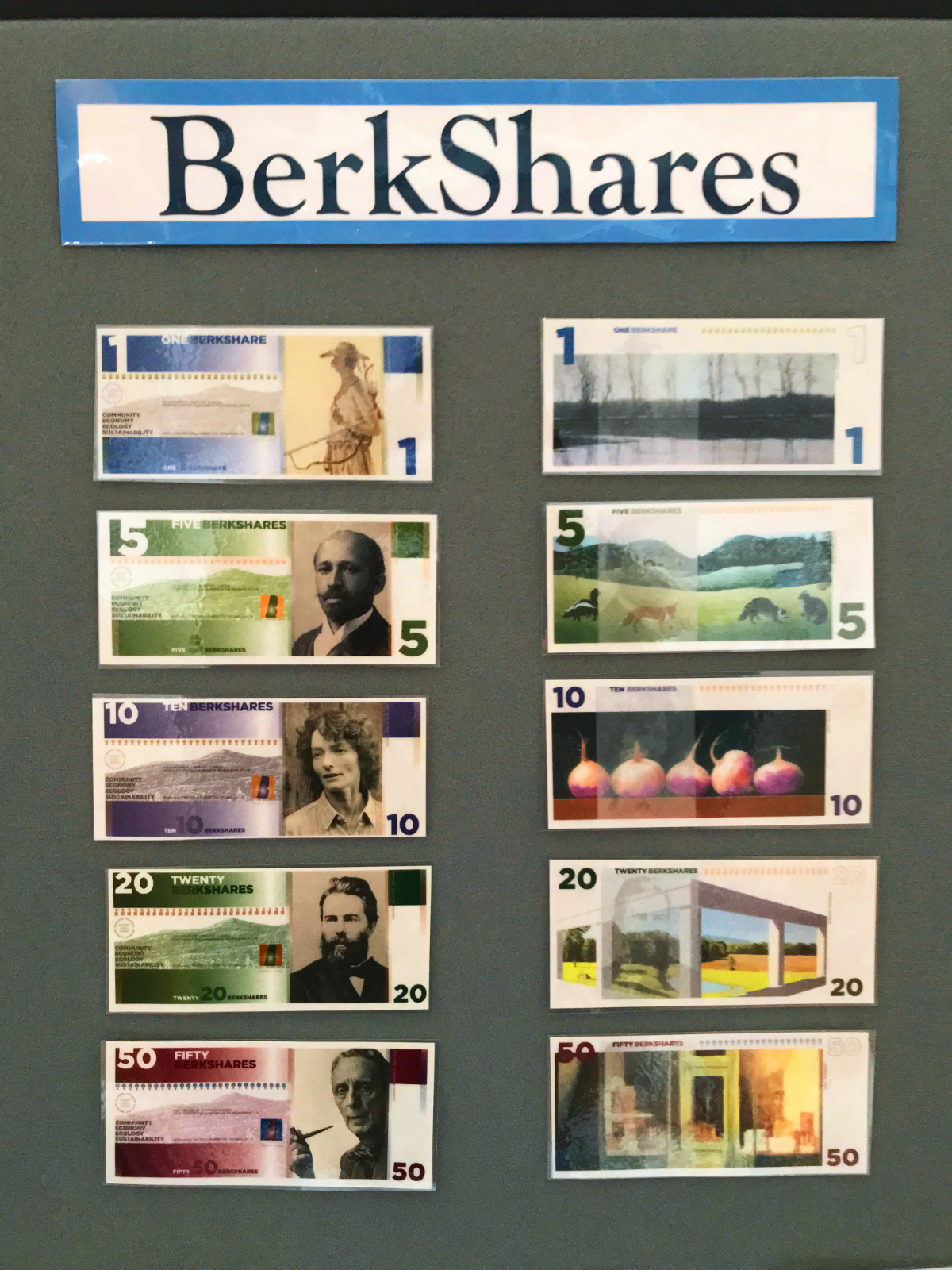

We had the good fortune, way back in 2015, to speak with Alice Maggio, who was spearheading the effort to grow the adoption BerkShares, a local currency that was started for the Berkshire region. Launched in 2006, the program is celebrating its 15th year. Her hard work and expertise, and that of the rest of those involved at the Schumacher Center for a New Economics, have been paying off, with hundreds of local businesses readily accepting the currency as payment for goods and services. Up until now. It’s been a paper currency that features local heroes like W E. B. Dubois and Herman Melville, using signature colors and artworks from local artists. Now that the proof-of-concept stage is well past, it is only natural, perhaps, that it’s time for the beautifully designed notes evolve.

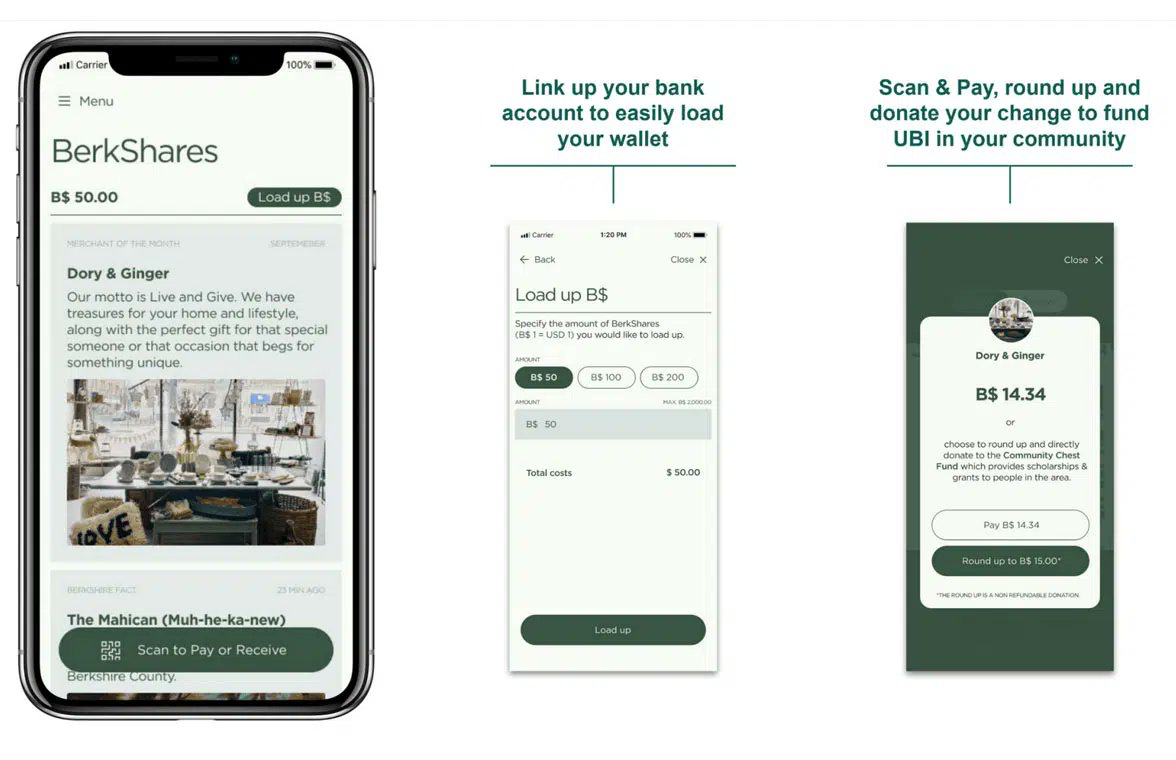

Starting next year, residents and businesses will be able to transact using digital BerkShares via a phone app.

In one way, the digital version of BerkShares will be a payments app, similar to Venmo. The whole idea, though, centers around keeping money working locally within the region, which benefits economic development in the area in a responsible and sustainable way.

BerkShares are valued one to one against the US dollar, but, as a locally issued currency, stands on its own. Currently, more than 400 vendors participate, giving people the opportunity to use BerkShares at the wine store, the farmers market, the auto mechanic, or even to get their teeth cleaned at the dentist. The program is useful specifically because of the diverse range of services and product sellers who exchange in BerkShares, which keep the money circulating within the area.

Jared Spears, Director of Communications and Resources at the Schumacher Center for a New Economics, explained how the digital version of BerkShares will plug in to the larger economy.

“We have merchants who have been recirculating the money,” he said. “They’ll take it and use it for the services and products that they need. And then they also interact with local banks, typically located in the southern Berkshires, who can take in the paper money and give back U.S. dollars. One of the things that we’re excited about with the launch of the app is: anybody who lives in the region can connect to any bank account to upload money. From there, it’s free to exchange and to pay via BerkShares, and there’s just a small 1.5% fee if and when a merchant decides to cash out — less than Venmo and way less than credit cards. So it’s basically one of the most local business–friendly ways to pay.”

Fennie Wang, with the public benefit corporation Humanity Cash, is one of the folks behind moving BerkShares into cyberspace.

“We’re building the the technology behind digital BerkShares,” Wang explained, “so we’re building an app that has functionality similar to Venmo. You’ll pay through QR codes, and the transactions will run over a third party blockchain network, which is how we can avoid those extractive fees [business incur] whenever you use Visa or MasterCard. Your favorite small business is getting hit with three to four percent fees just for taking your money.”

Although many more people are familiar with the terms blockchain and cryptocurrency at the end of 2021 than back in the 20-teens, adoption of the technology has been slow. In part, the general public has had understandable difficulties wrapping its head around the computing concepts underlying cryptocurrency — they aren’t easy to sum up in a short sentence. The other barrier to acceptance has been the lack of apps that simplify and streamline the process of using cryptocurrency on a day-to-day basis. Spears and Wang predict that digital BerkShares, living right there in people’s smartphones, both iOS and Android, are likely to catch on.

For those who’d like a little bit of info about the crypto nuts and bolts of digital BerkShares, Wang breaks it down in a way that makes sense.

“We’re working with the Celo blockchain,” she explained, “which is a derivative of the Ethereum blockchain. So it’s a separate blockchain, but it is designed to be carbon neutral, with fast settlement times, which is how we’re able to have no transaction fees when you transact in BerkShares, unless you want to move back to US dollars, right.”

Converting the local currency to USD is obviously necessary from time to time, since businesses have bills to pay with suppliers of goods and services that don’t accept BerkShares. Even here, the program is designed to keep the currency close to home, says Wang.

“The important thing,” she noted, “is that we’re working with the local banks to keep the underlying US dollar reserves. The job of Salisbury Bank is to recirculate the US dollar portion of it into the local economy in the form of small business loans and mortgages to local residents. That’s also critically important for financial inclusion.”

Lee Bank, Spears added, is the other community bank backing the digital currency, and that name recognition is likely to go a long way towards reassuring potential adopters of the reliability of the endeavor.

Wang explained that all those three percent fees charged by the huge multinational institutions really do ding not just specific businesses, but the local economy as a whole.

“We’re making sure that our money doesn’t get siphoned out to Chase bank or Wells Fargo,” she said, “which is what happens when you use a credit card or Venmo, right? Those are the banks that they work with — these big national banks — and so they get to benefit from your capital rather than our local community banks whose job and mandate is to recirculate that capital locally.”

Writing for the journal, the Nonprofit Quarterly, Spears links that syphoning away of local dollars to other harms that mostly go unseen:

As many Americans now realize all too well, present-day financialized capitalism, with its huge stock buybacks and asset inflation, has fueled the nation’s widening economic inequality. A handful of America’s largest financial corporations are also leading investors in global fossil fuel extraction. With BerkShares, by contrast, reserves are held with individual community banks, which reinvest directly via lower-risk loans to start-up farmers and other small business ventures

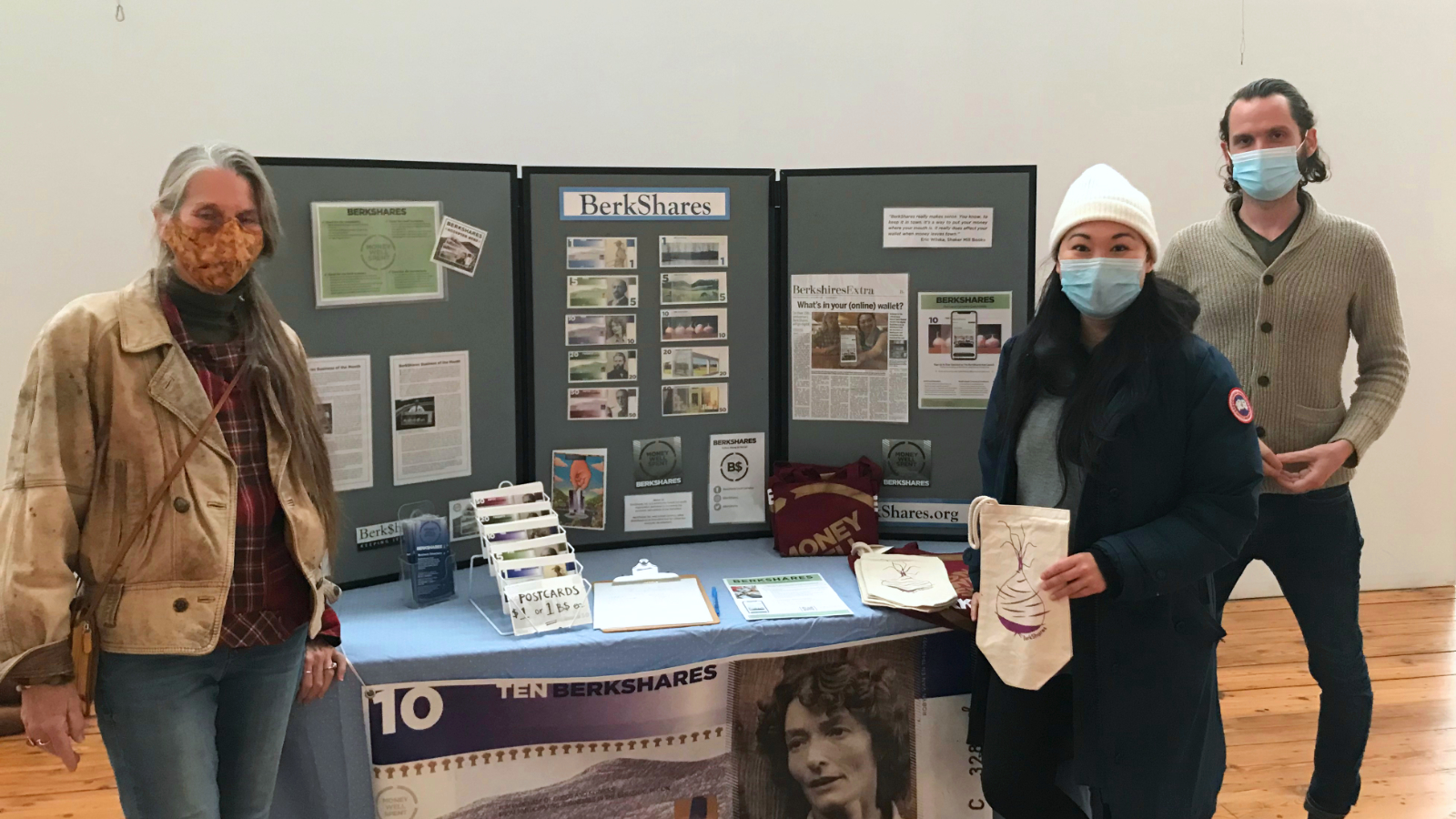

Elaborating on the theme at the Winter Market, Spears drilled down to exactly how local currencies can alleviate some of the imbalances.

“Why a local currency?” he repeated. “Yeah, it’s a great question. I think the way that we think about it at the Schumacher Center is that, first and foremost, it’s a way to empower a community to help to better determine the economic future of the area. So, when we think about the national currency, you know, obviously that does what it does. But there’s no reason why, at the local level, you can’t issue your own currency and design the way that it works in a way that works for your community. So, for us, we think about the concentration of Wall Street and big finance into fewer and fewer hands. Obviously, we know that there’s economic inequality that’s only been widening in recent decades. We think about economic justice and equity. And these are all values that we want to be embedded within our currency as they are within our community. Being able to introduce a digital variant for BerkShares is our way to hold those values dear and make sure that they’re embedded into the way that that we shop.”

BerkShares volunteer and Berkshires resident, Leah Barber, echoed Spears’ sense that money spent should reflect the ideals both of the shopper and the wider community of people who want to see an empowered, sustainable local economy.

“Well, I’ve been in the Berkshires for a long time,” Leah recounted, “and I’ve been using BerkShares — the the beautiful paper money — for a long time, and I’m learning more and more how it really underscores both the identity and the culture and well as the economy of the Berkshires. And I’m fascinated by it moving into the app because I think it makes perfect sense, especially post-COVID: you know, to be expanding. I’m really learning about all of this myself — but everything Jared and Fennie are saying appeals to my social conscience, my moral conscience, and my love of the Berkshires and the identity and community of the Berkshires. I think this is a way of maintaining and supporting this beautiful thing that we have.”

The question that may arise for people who pay attention to the cryptocurrency markets is whether or not digital BerkShares will be the next hot new coin on the block(chain). Wang explains why there will never be the wild fluctuations in the value of BerkShares due to an investing frenzy.

“The other thing,” Wang said, “is that it’s not a speculative cryptocurrency, because we need to make sure that what we’re doing is fully legally compliant, and that it’s stable, and that it’s something that people can rely on and feel safe, and that’s why it is pegged to the dollar. Exactly one to one. Exactly, and it can’t go up.”

So, if you missed out on becoming a Bitcoin millionaire with just $100 investment when it was first “minted,” you’re out of luck if you were hoping to become one of the first BerkShares millionaires. On the other hand, by shopping with BerkShares (and accepting them if you run a business) you’re investing in your community in a way that costs you next to nothing, but pays big dividends as far as a healthy local economy is concerned.

You must be logged in to post a comment.